The False Promise of Network Effects

Network effects are often cited as the ultimate competitive advantage yet we’ve seen numerous startups stall after initial enthusiasm.

Look at Nextdoor and Care.com. Both marketplaces scaled to hundreds of millions of revenue and built digital trust around two sacred assets—our homes and children. But Facebook Groups upended their value propositions. Sheer liquidity and ease of use may be more valuable than specialized trust.

Groups also bolstered Facebook’s retention—my wife and I lost interest in Facebook’s main feed, yet our accounts are essential to access neighborhood information and hire local nannies.

Growth investor

elaborates on the exponential value creation potential of groups within a network:We are going to see [more networks driven by] Reed’s Law…That is the value of the network is proportional to the groups and subgroups that are formed…We’re moving towards a world where we want to connect with users with vertical interests.

Network effects help drive growth but they require deep roots and consistent pruning to persist.

Digital Durability

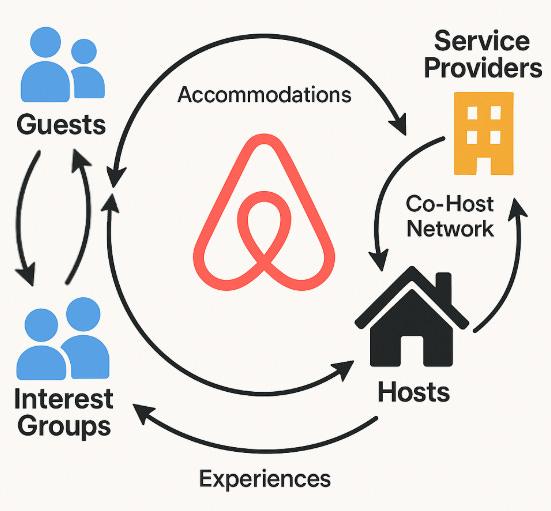

Instead of catering to Wall Street by launching sponsored listings, Brian Chesky is designing an interwoven and entrenched ecosystem that can’t be easily replicated. He’s reinforcing the network effects by building new networks on top of the existing two-sided marketplace. Airbnb envisions multiple self-reinforcing businesses and services.

If you think about Airbnb as a supply-driven marketplace, it seems obvious to press supply as much as possible. Back in 2016, Stratechery’s Ben Thompson argued Airbnb should incorporate hotel bookings:

With just a few tweaks to its business model Airbnb can take on the OTAs with a product that has a better front-end user experience, doesn’t need to pay to acquire users (because they already have them), and can direct that savings either to the bottom line or back to hotels (although the OTAs use of most-favored nation clauses could limit this). Oh, and by the way, Airbnb would be the only OTA with a huge selection of couches, rooms, and houses, making their potential offering not just better than Priceline and Expedia, but their market bigger as well.

Nine years later this is still a viable strategy to boost conversion and growth metrics. But then Airbnb would evolve into a well designed OTA fighting it out with Booking.

Brian Chesky is more ambitious. If you disaggregate the Airbnb marketplace into two separate businesses, he wants to further entrench both hosts and guests on the platform. In my initial memo, I highlighted the Co-Host Network as a strategic initiative to lock in more proprietary supply.

On the guest side, Airbnb wants to learn more about user preferences and hobbies. Here’s Chesky on the Q1 2024 earnings call:

We're going to be investing a lot more in increasing our profile capabilities–cleaning up account structures, identity verification, getting more people to complete robust profiles so we have more information about people. This is so strategic because as trust goes up, you can unlock more things for people…And as we know more about you, we can match you better.

If you think of Airbnb as the solar system, the home is like the sun at the center of the solar system. In the future I think the profile will be at the center of the solar system of Airbnb and the home will be one of many categories orbiting the profile.

If you’ve booked a trip recently on Airbnb, you’ve likely been prompted to fill out your profile with interests and hobbies.

Let’s storyboard this out and imagine what Airbnb might look like as a 7-star experience.

I’m obsessed with running. At home, I’m familiar with my favorite routes and I can tap into local run clubs through Strava or Facebook Groups. But when I travel I’m left exploring new cities on my own.

In June, I’ll be in Toronto for 48 hours for a management meeting and staying at a Residence Inn downtown. Prices were actually comparable to Airbnb but flexible check-in nudged me to the traditional hotel. But imagine through Airbnb I can easily tap into Toronto’s running community and join a group for an early morning run along Lake Ontario. Post-run we debrief at their favorite local coffee shop downtown. This shared interest can transform an impersonal work trip where I’m locked into my Airpods at the Starbucks next to the hotel into an immersive Experience where I can feel the soul of Toronto.

Interests also help Airbnb lean further up-funnel with inspiration. Certain trips are centered around events. For example, Badwater Cape Fear is an ultra running experience that takes place on Bald Head Island in North Carolina each year. You have to take a ferry to Bald Head Island and the isolated location was picked deliberately:

There are no hotels on Bald Head Island, however there are a few hundred vacation homes and cottages, some small enough for one or two couples and some large enough for groups of 20 or more. We encourage all entrants to STAY ON BALD HEAD ISLAND!

The whole concept of the event is a Spring Break Vacation and Badwater Family Reunion, but you have to be on the island to really partake in all that! (Badwater races are never just about the running.)

With a robust interest graph, Airbnb can highlight relevant events like Badwater while cross-selling nearby homes. This is the reinforcing business model management envisions.

Oh, and by the way, if Airbnb executes this ambitious vision, hotels will be flocking to their platform. As

advises, Airbnb is building the garden that the butterflies will fly into.

Is it a false promise or a false understanding, mixed with limited vision?

I appreciate the awareness of Airbnb's holistic perspective on travel as an experience that inquires users bring their entire habit structures with them ^_^ Thanks Stephen!